Privacy in crypto space is a hot gist right now. Also, governments are clamping down on virtual assets. So, it’s no wonder everyone out there is on the lookout for the most efficient crypto exchanges in 2026 that do not need Know-Your-Customer (KYC).

Many need platforms that let them trade or purchase digital currencies without their ID being flagged. Some just want to bypass all the stress of the liveliness check, email, and the entire verification hoops. Whether it’s privacy you want, dodging geo-blocks, or zero hassle while trading, anonymous trading is becoming a hot cake. Many traders now actively seek KYC-free services that let them buy and sell without revealing personal information. KYC (Know Your Customer) protocol exists to eradicate money laundering and fraud.

But, honestly, it’s as if you’re giving out too much private information. The good news is, there are plenty of decentralized or semi-centralized exchanges out there where you can still swap, sell, and buy all sorts of crypto without handing over your info.

This is so for smaller trades or when sticking to decentralized protocols. And, DEXs can be a little trickier if you’re not super techy, but the privacy boost is worth it.

In this guide, we’ll break down the best no-KYC crypto exchanges for 2026, what makes them tick, and why they’re perfect if you want to keep your crypto trading on the down-low.

Quick List: Best No-KYC Crypto Exchanges in 2026

Here’s a snapshot of the top platforms where you can trade crypto privately — no ID checks, no verification hoops.

| Exchange | Type | Best for | Key features |

|---|---|---|---|

| Bitania | Peer-to-Peer (P2P) | Anonymous global trading | No KYC ever, supports BTC, XMR, ETH, and LTC P2P trading with all possible payment methods, and has low fees |

| Uniswap | Decentralized Exchange (DEX) | Swapping ERC-20 tokens | Trade without KYC up to limits, early token listings, leverage options, and low fees |

| PancakeSwap | DEX on BNB Chain | Low-cost, fast swaps | Tiny gas fees, staking & yield farming, NFT marketplace, privacy-first BNB ecosystem |

| MEXC | Centralized (semi-KYC-free) | Altcoin & futures trading | Trade without KYC up to limits, early token listings, leverage options, low fees |

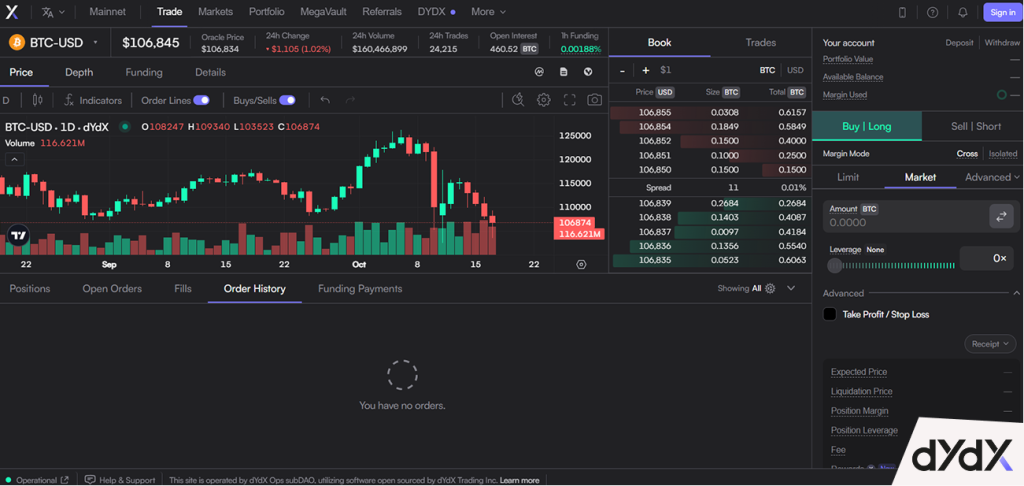

| dYdX (v4) | Fully Decentralized (Cosmos) | Perpetual trading with leverage | Up to 20x leverage, self-custody wallet, on-chain order book, advanced analytics |

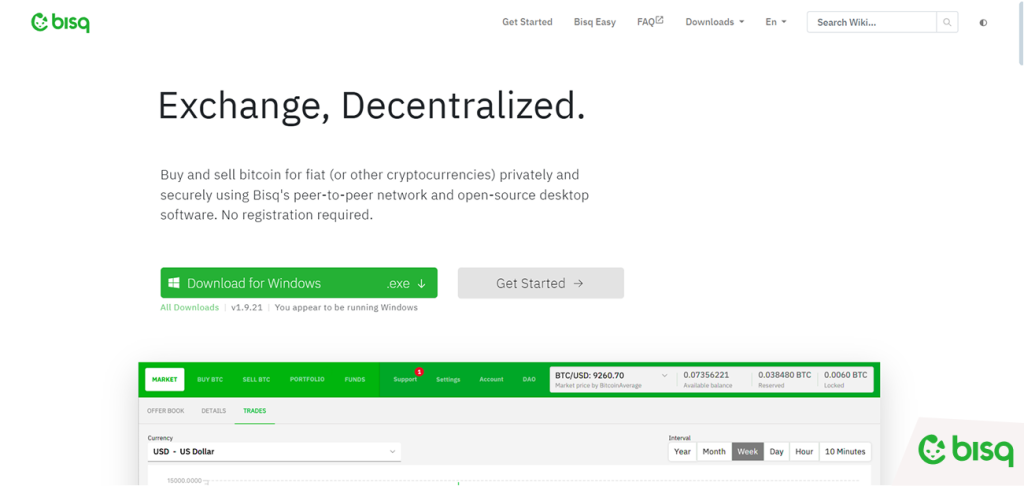

| Bisq | Peer-to-Peer (Tor-based) | Bitcoin-to-Fiat privacy trading | Runs on Tor, supports bank and cash payments, no central servers, built-in escrow & arbitration |

Editor’s Pick: Bitania.com – Best overall for privacy-focused users who want a secure, true peer-to-peer trading experience with zero KYC requirements.

Crypto Trading: A Peek-A-Boo

So, what’s crypto trading? It’s really just selling and buying digital stuff—Bitcoin, Ethereum, a bunch of altcoins—on online platforms called exchanges.

As crypto’s gotten more popular, the number of exchanges has shot up, serving everyone from complete beginners to hardcore traders. The big, centralized crypto exchanges usually have super-friendly interfaces, so it’s a breeze for newbies to jump in.

The top exchanges offer low fees, high liquidity, and all sorts of advanced order types to help you trade smarter and bigger. These days, many of them go way beyond basic buying and selling—you’ll find futures, copy trading, margin trading, all kinds of cool features to keep pros and regular folks interested.

When you’re comparing exchanges, keep an eye on spreads and trading fees. They can really eat into your profits if you’re not paying attention. All these new features and platforms make it easier than ever to swap, sell, buy, and manage your crypto, whether you’re building a portfolio, hedging your bets, or just having fun exploring the wild world of digital assets.

With a myriad of exchanges out there, you’ve got choices. Want low fees? Tons of coins? Special trading tools? Choose what’s just right for you. More competition means better services, more safety, and possibly the ability to trade with more exchanges.

Maker fees are usually between 0.00% and 0.40%. On the other hand, taker fees are around 0.05% to 0.60%, but it depends on the platform you pick and how much you’re trading. If you’re moving big volumes, you’ll usually get better deals on spreads and fees. Every bit counts!

A Snappy Read about Exchanges with No KYC

Before you jump in, keep these in mind:

- A good number of these exchanges are decentralized (DEXs), which means no central bodies are in charge.

- Some centralized crypto platforms allow clients to KYC to trade small amounts, but there is typically a limit to the amount you can trade.

- The regulations of the space are changing rapidly, and you should always verify the current regulations before using any exchange.

- The greatest privacy and security come from using your non-custodial, secure wallet while trading on these networks.

Why Opt for Crypto Exchanges without KYC?

No KYC exchanges are a big win if you care about privacy or just want to skip all the paperwork. You don’t have to upload any ID, so you can jump right into trading—super quick and way more anonymous.

Just keep in mind: if your exchange goes bust, your crypto could be gone, and there’s no government protection like you’d get with a traditional bank. If someone hacks your account, that’s on you, too.

One of the best things about no KYC exchanges is how flexible they are. You can usually start trading right away, and it’s easy to use debit cards or bank transfers without waiting ages for approval.

Lots of these platforms have handy mobile apps, so you can trade wherever, whenever. Sure, sometimes the fees are a bit higher or the liquidity isn’t quite as deep, but for a lot of folks, the extra privacy and control are totally worth it.

Just don’t forget: if you keep your crypto on an exchange, you’re taking a risk. Always move your assets to your own wallet if you can. In a nutshell, the best no-KYC crypto exchanges are excellent for those looking to trade on their own terms. Be smart, safe, and enjoy the freedom of true privacy!

If you want to sell, buy, or simply look into new crypto coins without hassle, then exchanges without KYC are definitely your best option for remaining anonymous.

Best Exchanges for Anonymous Crypto Trading Today

Finding the best no KYC crypto exchange depends on your trading style and the level of privacy you want. Below are six trusted platforms that let you trade freely without identity verification.

1. Bitania

Want a spot where you can trade crypto with other folks, no ID checks, no “prove you’re not a robot” nonsense?

Bitania is made for you. It’s peer-to-peer, lets you trade Bitcoin, Monero, Litecoin, Ethereum, and USDT, and honestly, it feels a lot like the good old LocalMonero days, just with a few upgrades and a team that actually listens.

Bitania’s all about keeping things simple—no KYC, no AML now or ever. The team’s pretty set on the idea that forcing people to hand over their info totally goes against what a peer-to-peer crypto marketplace should be. As long as there’s a legal way around it, they’re making sure you can trade without jumping through a million hoops.

Fees? Pretty chill.

You won’t pay any deposit fees, and withdrawals are basically what you’d expect from a regular blockchain transaction. If you’re sending crypto to another Bitania user, it’s free. And their support team? Quick and really helpful—no unanswered tickets, usually within 24 hours.

Just like LocalMonero, Bitania supports any payment method, any currency, anywhere on the planet. They don’t ditch payment options, and they’re cool with face-to-face cash trades if that’s your style. Every trade’s protected by an arbitration bond, so buyers and sellers both get a smooth, safe experience.

Bitania notably restores privacy and control to you and enables peer-to-peer trading without the effort or headache.

2. Uniswap

Uniswap stands tall as the go-to platform in the DEX market on Ethereum. And, when it’s time to swap ERC-20 tokens anonymously, it wins! Ideal for swapping Classified ERC-20 Tokens.

Why?

No KYC or sign-ups. It doesn’t even have any limits! You only need to link your MetaMask wallet or WalletConnect to Uniswap and you’re good to go! Also, if you’re using a Layer-2 network, like Optimism or Arbitrum, you will get low fees and fast trade execution with no KYC requirements.

You’ll save big on gas fees. Uniswap has a massive selection of assets—stablecoins, altcoins, meme coins—so you’re almost guaranteed to find what you’re after. Trading volume is high, so trades go through quickly, and you usually get a good price.

Uniswap is totally decentralized, nobody’s holding your funds or asking for your details. Connect your wallet, pick your tokens, make your swap—that’s it. The interface is simple enough for newbies, but just remember to keep an eye on gas fees and slippage.

Uniswap really changed the game for DeFi trading. You get access to thousands of tokens you won’t see on regular exchanges, and the whole thing runs on liquidity pools (not order books), so it’s all about swapping directly, no middlemen involved.

Uniswap gives you a secure, easy way to trade a huge range of coins without sacrificing your privacy. So if you want to stay in control and keep things anonymous, it’s a solid pick.

3. PancakeSwap (BNB Chain DEX)

PancakeSwap has a reputation for being the go-to decentralized exchange on the BNB (Binance Smart Chain). If you’re after quick, anonymous digital assets trading with barely-there gas fees, you’ll love it. Best for, fast, cheap, no-KYC trading on BNB Smart Chain.

No sign-ups, no ID checks—just link your wallet and you’re ready to roll. The platform offers a ton of tokens, from meme coins to synthetic assets and NFTs. It’s grown way beyond just swapping tokens.

You’ve got staking, yield farming, an NFT marketplace, and even a lottery—so there’s always something going on if you want to grow your bag and keep your privacy. BNB Chain’s setup means transactions are lightning-fast and easy on the wallet.

Compared to Ethereum’s gas fees, it’s night and day—absolutely perfect for smaller trades where high fees would be a buzzkill. Plus, PancakeSwap spices things up with lottery and prediction games, so you get more than just boring swaps.

The liquidity pools here usually have pretty sweet rates, and their CAKE token? You can stake it for extra rewards. PancakeSwap has painted an ideal image for itself in DeFi, with new features as well as security systems emerging constantly. In fact, this platform wins if you’re looking for a balance between privacy, affordability, and functionality.

PancakeSwap is a great pick for anyone who wants cheap, no-KYC trading with a bunch of opportunities to earn on BNB Chain.

4. MEXC

MEXC is one of those centralized crypto exchanges that still lets you trade without forcing you through KYC, at least for smaller daily withdrawals. Best for, centralized exchange, no KYC for lower volumes.

Even in 2026, it’s a favorite for people who want CEX perks—like leverage, limit orders, and a huge range of tokens—without handing over their personal info. If you want to withdraw a lot or use fiat, you’ll need KYC, but for most altcoin trading or using leverage, you can stay within the platform’s anonymous limits.

MEXC has a big selection of trading pairs, often listing new tokens before the big names, which is awesome if you like early-stage bets. Their interface is nice—good balance between advanced tools and user-friendliness.

You get spot, futures, and margin trading, all KYC-free up to the withdrawal cap. So, it’s a cool option for folks who want CEX features without giving up all their privacy. MEXC is known for speedy deposits and withdrawals, solid customer support, and pretty competitive fees.

Security is decent too, with multi-factor authentication and most funds in cold storage. If you want to chase new altcoins and keep things private, MEXC is a handy middle ground between full DeFi and those super-regulated exchanges. MEXC gives you a solid balance—centralized exchange features, but you don’t have to totally give up your privacy.

5. dYdX (v4 Decentralized)

So, here’s the deal—dYdX in 2026? It’s gone full-on decentralized, powered by Cosmos SDK. No more depending on some central server or company. Now, you can trade with leverage, skip the KYC nonsense, and hang on to your crypto yourself. Best for, anonymous Perpetual Trading on a DEX.

It’s a real win for anyone who doesn’t want their info floating around everywhere. With dYdX v4, you get to play with advanced trading tools and up to 20x leverage, all while staying private with your own self-custody wallet. Since it’s totally decentralized, there’s no single point of failure, no one to lock you out, and no one asking for your ID. Just you and your trades.

The platform’s super quick and efficient, with analytics that’ll make even hardcore traders happy. Plus, the order book model means better price discovery than those AMM DEXs. If you’re serious about trading and want that extra control, this is the place.

You can go long or short on a bunch of assets—no need to actually own them. dYdX’s tech is built for speed, handling tons of trades every second with barely any lag. The community calls the shots—token holders vote on changes and upgrades. For anyone who wants advanced trading without giving up security or privacy, dYdX is about as good as it gets.

If you want decentralized margin trading and don’t want to sacrifice your security or privacy, dYdX is honestly the best choice out there.

6. Bisq

Bisq is the go-to if you want to buy or sell bitcoin peer-to-peer, no questions asked. No KYC at all. It’s a decentralized P2P crypto exchange built entirely for privacy, without any central authority or KYC requirements. Best for peer-to-peer Bitcoin trading with no KYC. There are different payment methods to trade BTC for either fiat or altcoins; choices include Revolut, wire transfer, bank transfer, or even cash, which makes it work for just about anyone anywhere. It is a desktop app; some will consider this a little dated, but the goal is privacy and keeping everything secure.

Everything runs over the Tor network, so you’re basically trading in stealth mode. No central order book, no company holding your data, no single point of failure. You trade directly with other people, with dispute resolution and escrow built right in to keep things fair.

Yeah, you’ll need to download and install it, but that’s what makes it extra secure. Trades are locked in a multi-signature escrow until both sides are happy, and there’s a decentralized arbitration system in case anything goes sideways. Because it’s fully decentralized, Bisq can’t be shut down or hacked like a central exchange.

It isn’t as fast, and the user experience is somewhat basic. But, if you want privacy and to be free from censorship, anti-Bitcoin, aka Bisq, is the gold standard for anonymous trading of bitcoin. If you want to sell or buy bitcoin (or other cryptocurrencies) anonymously and securely, using regular payment methods, Bisq is pretty much the top choice.

Top Picks Based on Utility

Peer-to-Peer Trading? Bitania’s your buddy.

They support a bunch of coins—BTC, XMR, LTC, ETH, USDT—you can use any payment method, and there’s no KYC hassle. Plus, their support team actually responds, and privacy is their whole deal. If you like trading directly with people, this is your spot.

Swapping ERC-20 Tokens? Uniswap is the go-to.

The liquidity is deep, fees are low thanks to Layer-2, and you get to stay totally anonymous. Perfect for Ethereum token swaps without the middlemen.

Want Low-Cost Trading? PancakeSwap’s got your back.

Tiny gas fees on BNB Chain, and you also get cool extras like yield farming and staking. If you’re trading a lot, you’ll appreciate not getting nickel-and-dimed.

Looking for Hot New Altcoins? MEXC is where you’ll find them.

Tons of new tokens, with early access and no KYC up to a certain withdrawal limit. Honestly, great for checking out what’s new before everyone else.

Perpetual Trading With Leverage? dYdX is where you wanna be.

Fully decentralized, up to 20x leverage, and packed with pro tools—all while protecting your privacy. It’s a solid choice for folks who want advanced features without giving up their info.

Need to Trade Bitcoin for Fiat? Bisq is still the champ.

It’s peer-to-peer, runs through Tor, and supports regular payment methods. If you want privacy while trading BTC for cash, Bisq is about as private as it gets. Using Bitania along with one of these other top exchanges lets you make smart choices and keep your privacy intact. That’s the winning combo for crypto folks today. Pick any of these exchanges and you’ll be in control of your assets, have access to a big variety of coins, and enjoy an anonymous, secure trading experience. Whether you’re just starting, a seasoned trader, or simply care about privacy, these platforms are set up to help you succeed.

They aren’t just private—they actually deliver quality service too.

One last thing: the crypto space is changing fast, and privacy isn’t a given anymore. No-KYC exchanges give you more control, but you’ve gotta be a little extra careful and do your homework. Keep your wallets safe, make sure to explore multiple platforms, and don’t easily trust any site that guarantees full anonymity. At the end of the day, your virtual asset is your responsibility. Make smart moves and trade with confidence!

Wrapping Up

Let’s be real—no-KYC exchanges are awesome for privacy and skipping all the annoying ID checks, but there are risks. Anonymous crypto exchanges give you freedom, but you still need to stay alert and protect your assets with good security practices. Decentralized platforms can have scams, customer support is limited, and if something goes wrong, you might be stuck.

No-KYC exchanges just don’t have the same safety nets as regulated places. Phishing is always a risk, too—one wrong click and your crypto could be gone.

To keep things safe:

- Work with a secure wallet all the time, such as MetaMask, Ledger, and so on.

- Double-check contract addresses before sending anything.

- Avoid clicking on sketchy links or random websites.

- Do your research—platforms like Bitania can help you check things out before you buy or sell.

No-KYC is perfect for privacy, but it’s still important to stay vigilant and save yourself. Let’s be direct and keep it cool. If you want to stay secure and uphold your privacy in the no-KYC crypto realm, you need a safe combination of good judgment along with basic security practices. It’s not difficult, just basically common sense.