-

Federal authorities seized a critical domain, web3adspanels.org, used to store stolen bank login details for a massive fraud ring.

-

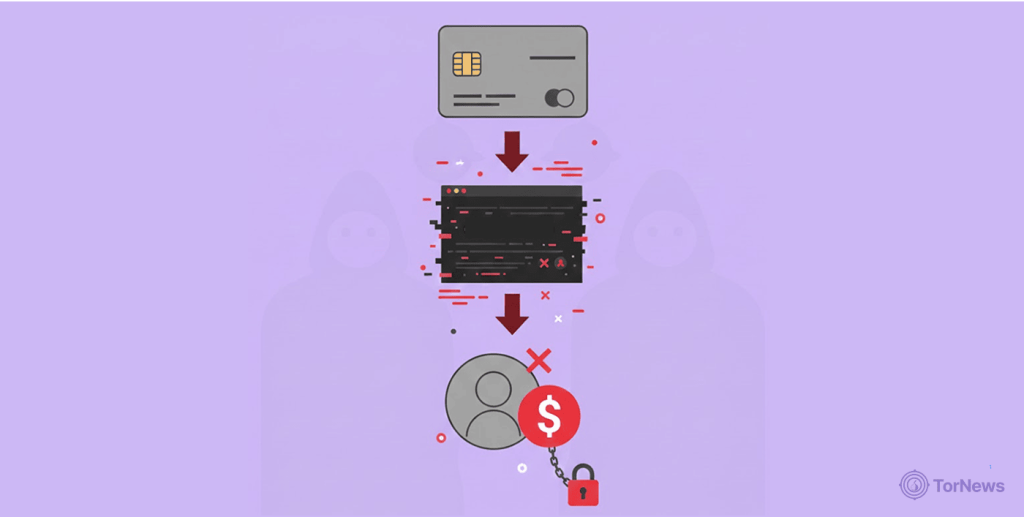

The criminals used fake search engine ads to trick victims into entering their credentials on malicious imitation bank websites.

-

This scheme led to over $28 million in attempted theft from U.S. victims, with nearly $14.6 million successfully stolen so far.

The US Justice Department just shut down a massive fraud scheme, as the DOJ’s December 22 official press release. The criminal group behind this scheme was stealing people’s bank login information using fake ads that looked totally real.

The DOJ seized the online hub where the crooks kept all the stolen passwords. This is a major disruption to their nasty operation.

How the Fake Ad Scam Worked

The whole scheme was alarmingly simple and effective. When you searched for your bank on Google or Bing, these criminals bought ads. Their ads looked exactly like the official, “sponsored” results from real banks like Chase or Bank of America.

If you clicked their ad, it didn’t go to your bank’s real site. You were sent to a perfect fake. It looked identical to the real login page. When you typed in your username and password to access your account, they were instantly stolen.

A malicious program on the fake site captured your credentials. The criminals then used that info to log into the actual bank website. Once inside, they simply drained the accounts. The stolen login data for thousands of people was stored on a server at web3adspanels.org, the domain just seized by the Feds.

A Global Multi-Million Dollar Heist

This scheme was far from a casual small-time scam. The FBI has already linked this group to at least 19 American victims. That includes two companies right here in Georgia. The total attempted theft? A staggering $28 million.

They successfully stole about $14.6 million before law enforcement caught on. The seized domain was actively being used to manage this fraud as recently as last month. This shows how persistent these cybercriminals are. The DOJ had released an announcement in late November, warning people about the account takeover fraud.

The investigation stretched across borders. Estonian law enforcement played a crucial role. They helped secure data from servers hosting the phishing pages. This international cooperation was key to the operation’s success.

Bank Account Takeovers are Surging

This case is just a snapshot of a huge problem. This year alone, the FBI’s Internet Crime Complaint Center received over 5,100 complaints about bank account takeovers. The reported losses exceed $262 million, which is no small financial loss. This surge in cyber-enabled fraud is met with targeted responses, as seen in the recent FBI operation that disrupted the dark web hackers behind the Qantas data breach.

Authorities urge everyone to be very careful and watchful. Keep a close watch on your bank accounts so that you’ll know when any suspicious activity is going on there. Don’t click search ads for your financial institutions. Instead, bookmark the real website or type the address yourself.

Treat any unexpected messages or calls about your accounts with extreme suspicion. The splash page now on the seized domain is a win. However, the fight is far from over, with the Justice Department targeting a wide spectrum of fraud—from bank phishing domains to crypto scam networks. Everyone must remain vigilant and well-informed about these threats.

They are now becoming more complex and also growing in magnitude. Therefore, the best way to remain safe is to protect yourself.