Exit scams are a common (rather constant) threat on illegal darknet markets and also in some other sectors, such as crypto. While the most common type involves a shady vendor (or platform) who takes your money and never sends the product, the scam can work both ways. Dishonest buyers can also receive goods and vanish without paying (it’s rare in crypto but common in darknet). On the dark web, the biggest risk, however, comes from the market operators themselves. They can simply shut down the entire site and run off with all the cryptocurrency held in the platform’s escrow system, stealing from every buyer and seller at once.

So, the online investment world offers big opportunities, but it also attracts serious risks. One day, a platform looks legitimate and trustworthy, and the next, it disappears without warning, taking investors’ money with it. The founders execute an exit scam by luring users with high promises and then vanishing once they secure enough funds.

These scams are far from rare. According to the FTC, investors lost over $5.7 billion to investment scams in a single year. In this guide, we’ll explain how exit scams work, share real-world examples, and highlight the key warning signs so you can protect your money before it’s too late.

Important Disclaimer: This article (like all other pages on TorNews.com) is for educational and awareness purposes only. We are not financial or legal experts. Also, we strongly condemn the use of illegal online marketplaces in first place, and this content does not constitute financial advice or an endorsement of any activity.

What’s an Exit Scam?

At its core, an exit scam is a type of investment fraud where the operators of a seemingly ‘legitimate’ business suddenly gather investor funds and disappear with it. It’s most common in crypto, forex, and “high yield” programs. They first build a trustworthy facade — a website, big promises, maybe even a community, and the moment the coffers are full enough, they shut it all down and ghost everyone.

One very typical example is a pop-up store claiming to run a “Going Out of Business” sale, but in reality, the owners never had a real business. They’d just collect cash from people and disappear.

It’s even more common nowadays that so many things have gone digital – fake online exchanges, NFT projects, and investment platforms are all over the place. Their goal? Build trust, gather capital for investors, then pull the plug.

It’s worrisome, really. According to a recent report by Chainalysis, people lose billions of dollars to exit scams and other crypto thefts yearly. This goes to show that it’s not a small-time crime, but a large-scale, organized threat that everyone should take very seriously.

How Do Exit Scams Operate?

Scammers don’t just act out of nowhere; they operate using a calculated, well-thought-out strategy. Exit scams generally fall into two categories; we’ll highlight their act play below:

1. Liquidity Pool Funds Gone (The Rug Pull)

This is the oldest trick in the book for DeFi scams, and people call it a rug pull. It goes after those decentralized exchanges (DEXs) like Uniswap, where people trade using these things called liquidity pools that users fund.

Here’s how it usually goes down:

- Setting up: Scammers make up some new token and pair it with, say, SCAMCOIN/ETH. To get things going, they throw in some of their own ETH and SCAMCOIN into the pool to get things moving.

- Get Everyone excited: They start shouting about it everywhere to get people to buy in early. As folks buy up SCAMCOIN, the price shoots up, and the pool fills with real money (like ETH) from new investors.

- The heist: Once the pool is swimming in ETH, the scammers pull the rug. Since they’re the ones who put the first money in, they just take all the ETH out of the pool.

- The collapse: The doors have been shut for SCAMCOIN. No one can sell the token anymore. The price drops to zero right away. The first people to buy are stuck with something that’s useless. This whole thing can happen in just a few hours or days after the thing starts.

2. Smart Contract Manipulation (The Code is Poison)

Developers bake some of these scams right into the code from the start. It is weird because the contract itself is the weapon.

Some common tricks in the code are:

- The never-ending token minting: There’s a secret part that lets the developers just create as many tokens as they want. All of a sudden, there are too many tokens, and the token loses all its value.

- The pixiu or honeypot contract: It is named after a creature that only eats; it lets you buy but not sell. You can put money in, but good luck trying to get it out. The trap only closes when enough people have put their money in.

- The sneaky backdoor: There’s a part that lets the person who made it take tokens right out of people’s wallets that are linked to the dApp.

The messed-up part? These tokens can sometimes pass a simple check on sites like Etherscan, because the bad stuff is hidden in tricky code or locked away for a while. That’s why you really need a reputable security company like CertiK or OpenZeppelin to check your project—it’s not just a nice-to-have.

3. Social Scams

- The Attractive Launch: The scammers create a slick platform, maybe a new investment fund, a crypto exchange, or a minting site for NFTs, with promises of high returns or low trading fees to draw people in. The website will be made to look professional, making you believe the project’s legitimacy (they won’t use templates; those are cheap and easily give off a fake vibe). And their marketing? It just hits all the right notes, often like a targeted sermon.

- The Trust Building Phase: At first, things will work smoothly – deposits and withdrawals will work normally. Their customer service might even be helpful and responsive. All of this is to build credibility, gain users’ trust, and encourage them to pour in more money. Sometimes, you might see fake testimonials, or they might pay influencers to hype the project and boost their image.

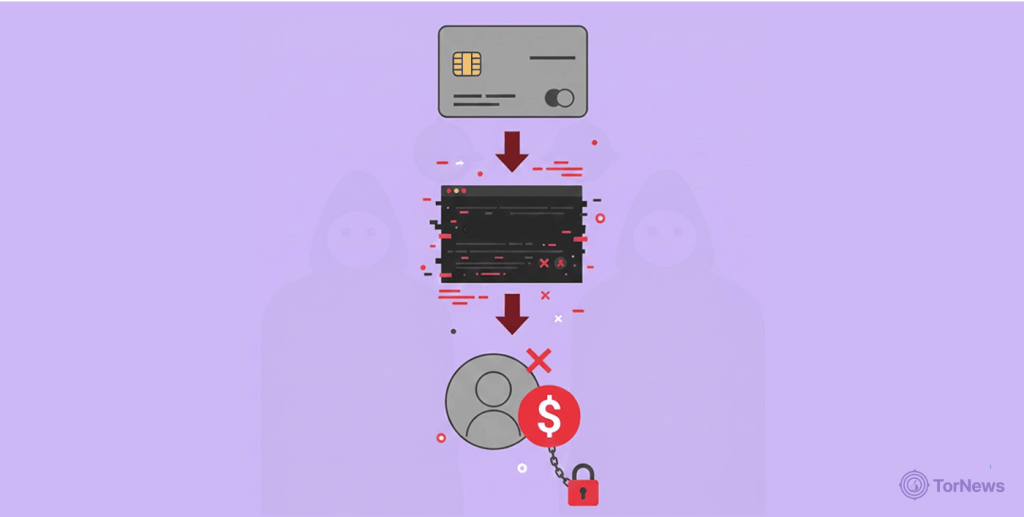

- Fabricated Crisis or “Routine” Update: Now they are about to pull the trigger. Operators of the platform/project will invent a problem: maybe they’ll say the platform got hit by a security breach, or there’s a banking issue, they might even say they are conducting a necessary platform upgrade or wallet maintenance. Sometimes, they just go silent without any explanation whatsoever.

- Disappearance: Then the website goes offline, and social media accounts are deleted. Support tickets go unanswered, and the team, which often uses fake identities, vanishes into thin air, and when you try to contact them via their communication channels, you hit a dead end.

- The Scammers Launder the Proceeds: They quickly funnel the stolen money (often in crypto due to its anonymity) through currency mixers or multiple wallets to cover their trails, making it nearly impossible to recover the funds.

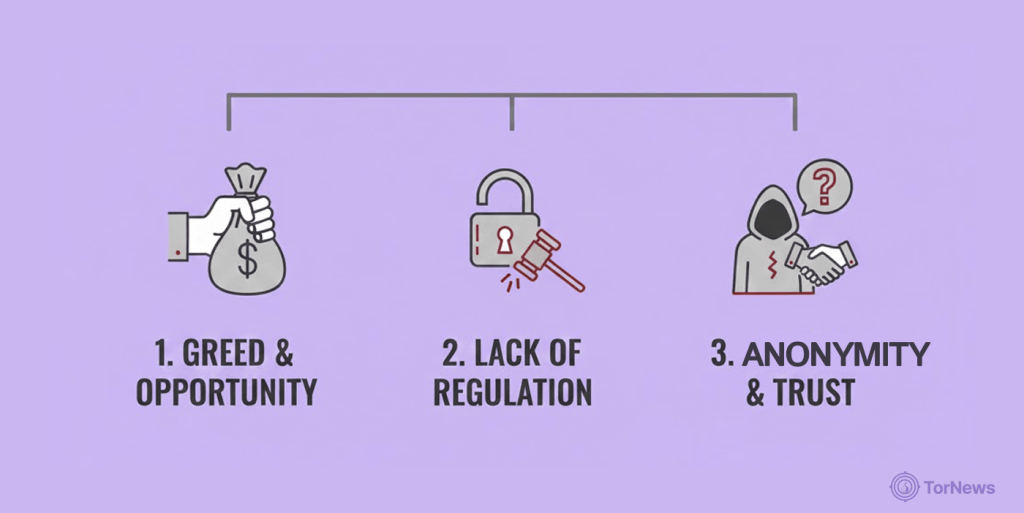

Why Do Exit Scans Happen? (The Psychology of Theft)

Knowing the why lets you guess the when. These choices aren’t random; they come after a serious pressure builds up.

1. The Temptation of Accumulated Funds

This is the main thing that fuels exit scams. Darknet marketplaces (and other similar platforms) keep user deposits and vendor money safe in escrow. Over time, this turns into a huge, tempting pot of gold. A successful platform could be holding millions at a given time.

The people running things start to see that cash does not belong to users, but is theirs for the taking. Funny enough, that their legit business is doing well makes them want to wreck everything. What an irony.

2. Pressure from Law Enforcement

Sometimes it’s fear, not just wanting to get rich (greed), that makes operators bail. When the people who are running the investment project think the cops are closing in, maybe through spies, blockchain analysis, or just old-school investigation, they might just grab the money and run instead of getting arrested. It’s a final, get-out-quick move.

While blockchain analysis tracks funds, uncovering the operators behind dark websites often involves dissecting the layers of Onion Routing. Our complete guide on the topic breaks down how this anonymity network works and its limitations (if you want to learn in detail).

3. Disputes Among Team Members

What happens when crooks have a falling out? Sometimes, exit scams are like a takeover from the inside. One of the leaders seizes control of the platform’s wallets and runs away before the others get a chance to stop them. Such kinds of scams take everyone by surprise, before you notice it’s already too late. One day, your withdrawal is just…pending. And that’s the first whisper.

4. Decline in Profits

Sometimes, why they flip the switch is simple: money starts to dry up on a marketplace, a better competitor steals the users, a scandal tanks the site’s reputation, or the trend has shifted.

The operators aren’t so passionate about the business; they care more about the money, so when the legitimate profit stream becomes a trickle, the giant pool of users’ funds in the escrow starts looking less like a responsibility and more like a retirement plan.

Rather than facing the music, they choose to up and run with everyone’s money placed in their care. It’s a mad move, but it happens. It’s not a business failure; it’s a calculated cash out.

And just because a platform played nice for years doesn’t mean you can trust them tomorrow. History is filled with platforms that had years of perfect service right up until the second they didn’t.

Spotting Exit Scams Early – The Tell-Tale Signs

It’s not always easy to identify which platform or investment program is an exit scam before it collapses, but you can spot it if you put your eyes down. Here are some of the signs:

Marketplace Warning Signs

- Hidden teams with fake or no names: Real deals have real people. Find the founders online, check their LinkedIn, and see real photos. Can’t you find anything on the team? Keep your money. Because no one wants to trust their money into the hands of someone hidden.

- Too-good-to-be-true returns: If you hear about mad returns that are guaranteed, like “10 percent every day, no risk!”—that’s a lie. That story always ends badly. Either it’s a scam or the operators are trying to gather up money before they disappear.

- All hype, no real product: When the project is being hyped everywhere, they pay promoters to sing their praises online, and they’re aggressively mounting pressure to get you to put money immediately to avoid missing out, yet you see no tangible product, no updates, just know that something fishy is going on. If they push you to buy now, stop and ask why. Usually, it’s not for you.

- No code checks or transparency: In crypto, if you can’t find a real audit from a company you know, like CertiK, you’re gambling, not investing. That’s a bad move.

- Withdrawing your money becomes an issue: Forget the people for a minute. Look at getting your money out. If it usually takes hours, but now it’s “28 to 48 hours for a security check,” then it’s “pending,” and you get an error; that’s a big warning. That’s not a tech issue. It’s time to leave, fast.

- The team goes quiet: Silence is the biggest sign. If support stops replying, announcements disappear, forums shut down, and all that’s left are automated posts, the people behind the gig are gone. They’re just keeping up appearances until you realize.

- No legal footprint: A real business has Terms of Service clearly spelled out, and you can read them, and a registered company number. Scams have vague, copied, or no legal documents. If you don’t know who you’re dealing with or where they’re located, you have no way of getting your money back if things go south.

- Turning off security: If a marketplace suddenly disables a feature that stops people from taking funds or turns off their multi-signature escrow, without a good explanation, game over. That means they are removing the locks on the vault and are probably about to bolt with your money.

- Forcing “finalize early” and less Escrow time: Pressuring buyers to send money before they get their goods, or making the time to finalize things shorter, is a trick to empty accounts quickly.

Community and Vendor Red Flags

- If you see trusted vendors leaving a platform for somewhere else, pay attention. They’ve got skin in the game and usually spot problems before anyone else.

- Vendor behavior changes all of a sudden — Reviews reduce overnight? They push for deals outside of escrow, or offer unrealistic quantities of stock? That tells you there’s fire on the mountain.

- Community chatter turns toxic – Folks in the community sound angry? Pay attention – something’s probably wrong. Check out good forums and review sites; when you see lots of people complaining about the same issue with getting their money out, it’s not just a fluke. That’s a real pattern. The crowd usually spots these things before any one person does.

But honestly, the biggest red flag? People can’t withdraw their money. If that happens, forget the other warning signs—nothing else matters. Withdrawal issues mean it’s time to get out. Combined with one or more of these signs? It’s a wreck.

Exit Scam Case Study: FTX’s Fall from Grace

The events surrounding FTX’s demise in 2022 have been bizarre to say the least. However, looking back on it now, it seems as though the company followed every exit scam step over the course of its last few months before it collapsed.

This just goes to show that even the most reputable and legitimate exchange can still fail if you ignore the signs.

Here are three factors surrounding the FTX fiasco:

- Problems with withdrawal: Customers had problems withdrawing their funds from FTX for several months before the collapse. Users filed numerous complaints regarding unsuccessful withdrawals, and instead of addressing these complaints in a timely manner, FTX attributed them to issues with their banking partners and “higher than normal” volume, which are classic stalling tactics that all scam artists use.

- False assurance: The CEO of FTX, Sam Bankman-Fried, continued to deny these complaints, appeared in interviews to say that FTX was fine, and created a false sense of confidence in his company.

- Total lack of transparency: The relationship between Alameda Research (the trading firm that was funding FTX) and FTX was very unclear. FTX has never provided any details regarding how much money was exchanged between the two firms or how they conducted their business dealings with each other. This lack of transparency should have served as a huge warning sign to anyone who was thinking about depositing their funds into FTX.

The lessons learned? If FTX, a company with billions and a great reputation, could show these signs and then tank, it means any platform can. No one’s safe just because things look good on the surface.

Can You Get Your Money Back from an Exit Scam?

You are probably never going to get your money back once you fall victim to an exit scam. Due to the anonymity of cryptocurrency and the fake names the scammers use, catching them is often a hard nut to crack.

That job is usually left to special cybercrime units, the police, or financial authorities, so your best bet would be to report your ordeal to them.

You may also file a report with organizations such as the FBI’s Internet Crime Complaint Center (IC3) in the United States and Action Fraud in the United Kingdom, or any other financial regulatory body in your country, or your country’s national police cybercrime unit, if available.

Reporting may seem like a futile thing to do, but it helps with record-keeping so investigators can have somewhere to start when solving the case. But honestly, the best solution is to stop the scams from happening in the first place.

Measures to Avoid Falling Victim to Exit Scams

Protecting yourself? It all depends on you following the rules, not some kinda magic trick. It’s simple:

- First, trust no one. Assume that any platform could someday disappear with your money –it’s not being negative; it’s just being smart.

- Do your own research. Don’t just believe the hype; check out the team’s background, what the project’s really about, and the code. If it’s crypto, a public audit report from well-known firms like CertiK is super important. No audit? Just forget it. Before you put money into a project, see how old their website is on Whois or Archive.org. If an exchange claims to have existed for three years because it has a domain that was created three years ago, but its website was only launched two months ago, it should raise some concerns about the accuracy of its information and services.

- It would be ultimately wise to only trade or hold bitcoin or other cryptocurrencies on larger exchange sites with high trading volumes and lots of liquidity, such as “Coinbase,” “Kraken,” or “Binance.” It’s true that even the big guys have their own problems every now and then, but the chances of them just upping and running with your money are low. Even if they do mess up, there’s a way and someone to hold accountable.

- Start small and keep your balances low. Try out a new platform with a tiny deposit and, most importantly, try withdrawing some cash first. If you can’t get a little out, you definitely won’t get a lot out later. Only put in what you need for right now. Take out any profit or extra money right away. Don’t treat a marketplace like a bank!

- And whatever you do, don’t get caught up in the FOMO (fear of missing out) trap. If you feel like you HAVE to invest RIGHT NOW, that’s a bad sign. Chill out for a sec.

- Never put all your money in one platform. Spread your activity around different platforms.

- When you identify vendors you can trust, create a means of talking to them securely (like PGP-encrypted channels) outside the marketplace.

- Read community forums and trustworthy dark web news regularly. Being aware of current events is your greatest protection. Part of this awareness is knowing the landscape. Familiarize yourself with the established, longer-running platforms. For a baseline of known entities (both legitimate and risky), you can reference our curated (and regularly updated) list of the most popular dark web sites to see if the platform in question is recognized (or conspicuously absent). Scams often spring up on new, unknown mirrors or clones, so sticking to well-documented, community-trusted venues is a wise first filter.

- Trust your instincts – feel something doesn’t quite seem right? It probably isn’t. Sometimes your subconscious mind first perceives signals you may have ignored, and your brain is trying to send a warning with those weird feelings you get. Listen to it! Seriously.

What to Do When You Suspect an Exit Scam is Happening

You think a crypto exit scam is about to happen on a platform you’re using? Here’s What to Do:

- Get Your Money Out, ASAP. Don’t sit around waiting for someone to say it’s official. Yank out every last bit you can.

- Next, cancel any active or open orders. Get that cash out of escrow and back where you can grab it.

- Stop depositing more crypto assets. Put more money, and you might as well just give it all away to charity.

- Shout it on the rooftops – tell people in forums what you discovered. Don’t try to play around it; let them know the facts. Like, my withdrawals on #XYZ’s been stuck for three days, or Bob the Admin hasn’t been online in ages.

- Time to get your Plan B rolling. Fire up those other marketplace accounts and give your trusted sellers a heads-up using your secret lines.

The Not-So-Fun Part: After the Exit, What Now?

- Face the music and accept your loss: It’s probably gone. Crypto transactions are irreversible. Those stolen coins? They’re likely history. And those recovery services? They’re probably just more scammers ready to jump on you.

- Figure out what went wrong: What did you miss? Were you keeping too much on the exchange? Learn from the experience and try not to let it repeat again when you invest next.

- Share what happened: Lay it all out there —When you give the full story, it helps everyone see the scams coming and stay safe.

False Alarms: When It’s Not a Scam (But You Should Still Act)

Not every bad sign means you’re getting scammed, which is kind of good news. Sometimes a site goes down ’cause the server crashed for real. Maybe withdrawals are stuck because the bank’s having a bad day. And if communication goes silent, it could be that the main developer is sick, not chilling with your bitcoin on some island.

Even when the authorities step in, like when they shut down some shady darknet market, it can look just like the site’s owners ran off with everyone’s money. You still can’t get to your cash, but it’s a legal seizure, not some thief, that’s got it.

How Do You Know What’s Real — And Does It Matter Right Away?

In the beginning, you have no way of knowing if it’s really a scam or just a false alarm, not until later when the platform either explains what transpired and corrects whatever went wrong. What if no one shows up to explain, and the problem never gets fixed? So you have to react like it’s a scam at first.

- With a false alarm, the site comes back with a full story about a cyber attack or a messed-up database, or an unexpected notice from the lawyers. Your money’s still there, operations resume, and they start talking again.

- But with exit scams, it stays quiet forever – their website vanishes into thin air, and social media is gone as well.

One thing to keep in mind: Don’t bother trying to guess what’s going on each time a site’s having a problem, act first, get your money out, and think later.

Think of it like a fire alarm going off – most times it’s just being tested, or a toast got burnt. But you still get out, right? Walking down the stairs isn’t a big deal compared to ignoring a real fire.

So, a ‘false alarm’ in crypto might mean you miss a quick chance to make some money, or you pull your funds for no reason. You lose a little or get annoyed. But ignoring an actual red flag? You know how that ends.

The rule of thumb is: better safe than sorry. If you spot a few red flags from the list, move your money first, ask questions later. If it turns out to be a false alarm, you can always deposit your funds back into the platform. But if it’s a real scam, you’ll have dodged a bullet—and be the one telling the story instead of getting ripped off.

Conclusion

The internet has an abundance of opportunities for those investing online, but you need to be alert, and skepticism is key. It’s not pessimism, it’s being smart enough to avoid getting ripped off.

Knowing how exit scams work and the signals to watch for keeps you from losing money. Focus on only using established platforms with a good track record, and be cautious of any form of pressure from FOMO (Fear Of Missing Out) pushing you to invest in something that doesn’t quite feel right. Your investments are worth the effort. Take care of it.

FAQs

They’re similar. A rug pull is an exit scam in DeFi, where developers empty the project’s funds from the liquidity pool, causing the token price to crash. Exit scam is what you call any scammy shutdown and disappearance.

Nope, but it happens more on crypto platforms because cryptocurrency makes it easier to move funds anonymously. Forex brokers and high-yield programs have been doing exit scams for ages too.

Pull your funds ASAP. Document everything: balances, messages, transaction info. Don’t deposit more. Tell others on social media and report it to the authorities.

Track your transactions. Make a simple spreadsheet noting dates, deposits, & withdrawal times. If withdrawals get slower, like from 2 hours to days, that’s a red flag. Also, set up Google Alerts for the platform’s name + withdrawal issues.

It can be hard to tell. Real failures mean sharing money problems, winding down, and trying to return money. Exit scams involve lies, made-up issues, and running off with the cash.

The Mt. Gox collapse back in 2014; people first thought it was a hack, but it looked like bad leadership and fraud were the real problems. Clearer examples? Think of the lending platform Bitconnect in 2018 and the crypto investment platform Africrypt (2021). The guys running those platforms just took the money and ran— we are talking billions of user funds.